Mortgages can have differing terms, including the variety of years it will certainly require to pay them off and interest rates. Every funding program has its very own unique eligibility requirements. Supplies funding of approximately 100% with no required deposit. Adhering to are three governmental programs that are understood to insure 100% fundings. Mortgages with no down payment are normally offered only with certain government-sponsored programs. According to FHA standards, you can receive a gift for the whole down payment.

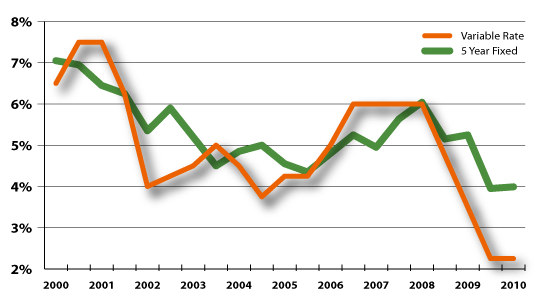

Unlike the security of fixed-rate car loans, adjustable-rate mortgages have changing rate of interest that can increase or down with market problems. Numerous ARM products have a fixed interest rate for a couple of years before the funding adjustments to a variable rates of interest for the rest of the term. As an example, you could see a 7-year/6-month ARM, which suggests that your rate will certainly remain the very same for the initial seven years and also will certainly readjust every six months after that first duration. If you consider an ARM, it's necessary to review the fine print to know just how much your price can enhance as well as just how much you can end up paying after the introductory duration ends. USDA lendings-- USDA car loans aid moderate- to low-income borrowers buy residences in backwoods.

- A totally amortizing home loan is a lending in which both principal and also rate of interest are paid fully via scheduled installments by the end of the lending term.

- You would certainly be amazed at exactly how easily accessible major cities are from USDA-eligible areas.

- Among other points, the QM guidelines need lenders to ensure borrowers have the economic capacity to repay their home loan on schedule.

- Whether your lending institution will require you to pay for exclusive home mortgage insurance.

Borrowing money Customers that borrow money are secured by regulation. Details on types of credit report, getting the best loan for your requirements and your right to privacy as an economic customer. Nonetheless, authorization in principle does not mean that the loan provider has accepted a mortgage and agreed to provide you this quantity. MiMutual Home Loan in Phoenix, supplies home mortgage for as reduced as $40,000, says Seligmiller, who includes that the interest rate for tiny fundings isn't as big as individuals may assume it is. A $75,000 financing can have a rate of interest that's 0.25 percent higher than a greater loan amount, he claims. Fannie Mae utilized to have a 5 percent cap on home mortgage costs for that finance variety, however they're currently topped at the buck quantity of $3,000 as opposed to a percent, Seligmiller claims.

In a no-cash home mortgage, the finance settlement costs are rolled right into the financing's principal equilibrium, as well as consequently the consumer spends for the negotiation prices with time with compounded rate of interest. This varies from the no-cost mortgage, where the debtor spends for the financing negotiation costs in the type of greater rate of interest costs on a reduced major equilibrium. A customer should perform a thorough evaluation to determine the most appropriate home mortgage choice. A no-cost mortgage is a home mortgage refinancing situation in which the loan provider pays the customer's finance negotiation costs and then prolongs a new mortgage loan. In a no-cost home mortgage, the lending institution covers the funding negotiation expenses for billing the customer a higher interest rate on their finance. While this reduces up-front prices at the time of refinancing, it boosts the month-to-month settlements and also overall expense of the lending over its lifetime.

Government Housing Administration Fha Loan

Lock-ins safeguard you against rate increases throughout that time period. To keep the home loan rate you've locked, you need to close your financing during that time. A lien is a lawful claim made on a residential or commercial property to secure the settlement of a financial debt. A mortgage is a kind of lien since your lending institution can confiscate your building if you don't fulfill the terms of the mortgage contract. A discount rate finance is a home loan where the purchaser has paid added money at near to get a reduced rates of interest.

Mortgagee

While debtors frequently plan to re-finance their home loan or market prior to that takes place, this isn't always feasible if the property market decreases in value. Some home loan have taken care of rates while others have flexible rates. A rate of interest is a percent that demonstrates how much you'll pay your loan provider every month as a cost for obtaining money. The rate of interest you'll pay is determined both by macroeconomic factors like the existing Fed funds price along with your personal situations, like your credit history, earnings and also possessions.

You have to find a method to get back on course and begin making your mortgage repayments once more before the grace period launched by your mortgage insurance coverage mores than. Personal Home loan insurance policy, on conventional fundings may be consisted of in your regular monthly repayment if you are placing less than 20% down. FHA as well as USDA call for a regular monthly mortgage insurance repayment, which will be included in your overall month-to-month payment. If you are light on resources or have a reduced credit history, an FHA loan may be an excellent suitable for you. FHA financings can additionally benefit a person who has had a current demeaning credit scores occasion such as foreclosure, personal bankruptcy, or a short sale. If the debtor requires support in qualifying, FHA lendings let relatives sign as non-occupant co-borrowers as well.